AI-Powered Invoicing for SMEs and Startups: Simplify Billing, Save Time, and Grow Faster

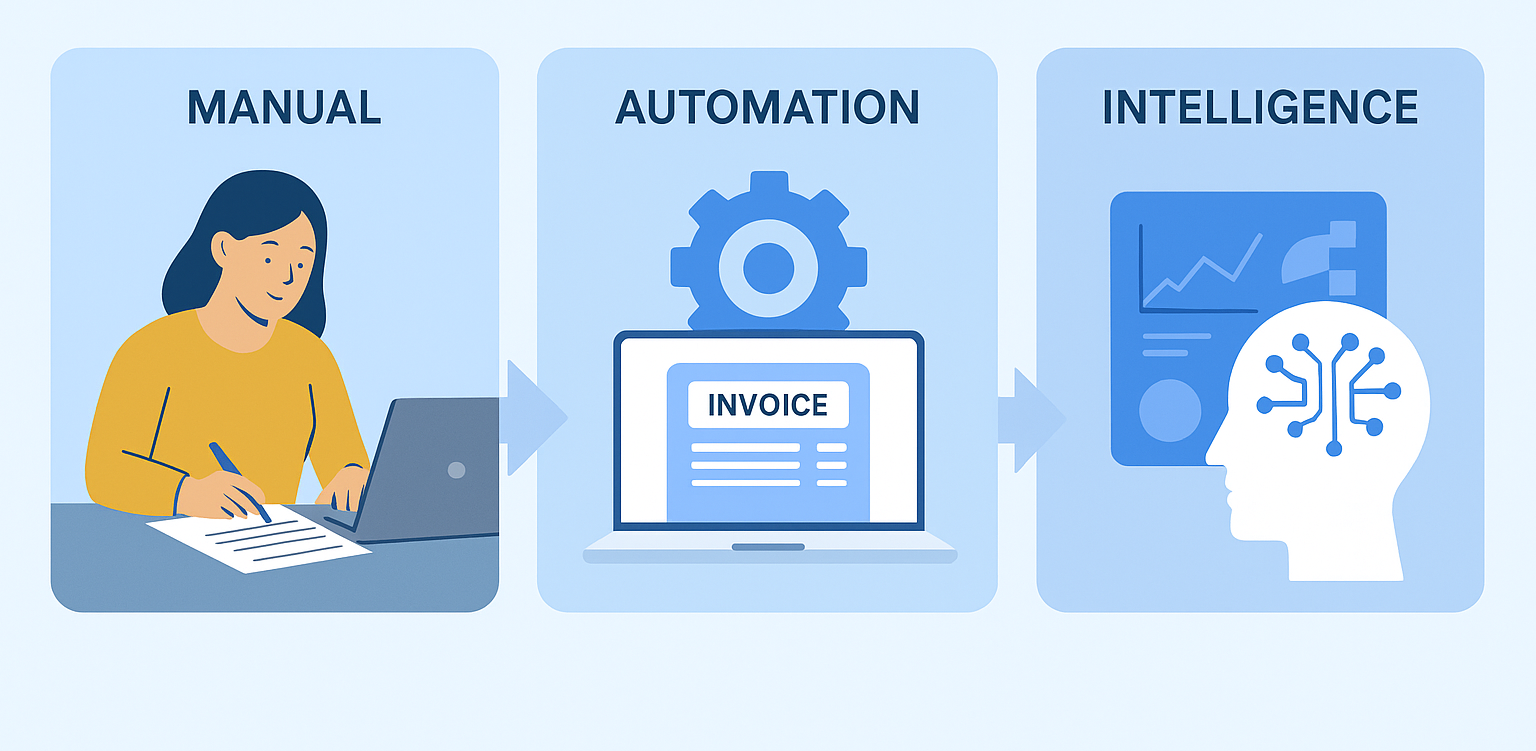

In the digital age, small and medium-sized enterprises (SMEs) and startups face unique challenges managing their finances while trying to focus on growth. Manual invoicing processes consume valuable time and are prone to errors, delaying payments and disrupting cash flow. This is where AI-powered invoicing software, like Invoiso.ai, becomes a game changer by automating and streamlining the entire billing process.

How AI Invoice Automation Works

AI invoicing uses advanced technologies such as machine learning and optical character recognition (OCR) to automatically generate, process, and track invoices. Instead of entering data manually, the system extracts key details including vendor information, invoice numbers, dates, line items, taxes, and totals directly from electronic or scanned documents. It then verifies this data against purchase orders and previous invoices to flag discrepancies and duplicates. Approved invoices are routed through predefined workflows for swift payment processing, and all actions are logged digitally for compliance.

Benefits for SMEs and Startups

Time Savings: Manual invoice creation and tracking can take up to 30-45 minutes per invoice. AI automation reduces this time drastically, allowing businesses to redirect over 35 hours monthly toward core activities like product development and customer engagement.

Error Reduction: Manual entry errors occur in approximately 12-15% of invoices, leading to costly disputes. AI achieves 90%+ accuracy by eliminating human mistakes, ensuring invoices are correct the first time.

Faster Payments: Automated reminders and smart scheduling boost collection rates by up to 23%, improving cash inflow and enabling early payment discounts.

Scalability: As your business grows, AI invoice systems handle increasing volumes effortlessly without extra staffing costs.

Compliance & Reporting: Real-time tax calculations, audit trails, and regulatory adherence help SMEs avoid fines and reduce accounting burdens.

Improved Vendor Relations: Faster, accurate invoicing creates trust with suppliers and reduces queries about payments.

Why Invoiso.ai for Your Business?

Invoiso.ai offers a cloud-based, AI-powered invoicing platform designed specifically for the needs of SMEs and startups in India. It supports GST-compliant invoicing with automated e-invoice generation to keep you audit-ready effortlessly. The software integrates seamlessly with your accounting tools and payment gateways, delivering a holistic financial management experience. Its intuitive dashboard provides real-time payment tracking and insightful analytics into your financial health, empowering smarter business decisions.

Getting Started

Transitioning to AI-powered invoicing is easier than you think. Start by digitizing your existing invoice processes and integrating Invoiso.ai with your current systems. Train your team on how to use the platform’s automated features. Monitor performance metrics like invoice turnaround time and error rates to maximize return on investment.

conclusion

For SMEs and startups aiming to optimize operations and accelerate growth, AI invoicing software is no longer a luxury but a necessity. By automating routine tasks, minimizing errors, and ensuring faster payments, Invoiso.ai helps modern businesses focus on what truly matters — building products, delighting customers, and scaling efficiently.

Embrace AI-powered invoicing today with Invoiso.ai and unlock new levels of financial efficiency designed for your business success.