Invoicing vs Accounting: Key Differences Every Business Should Know

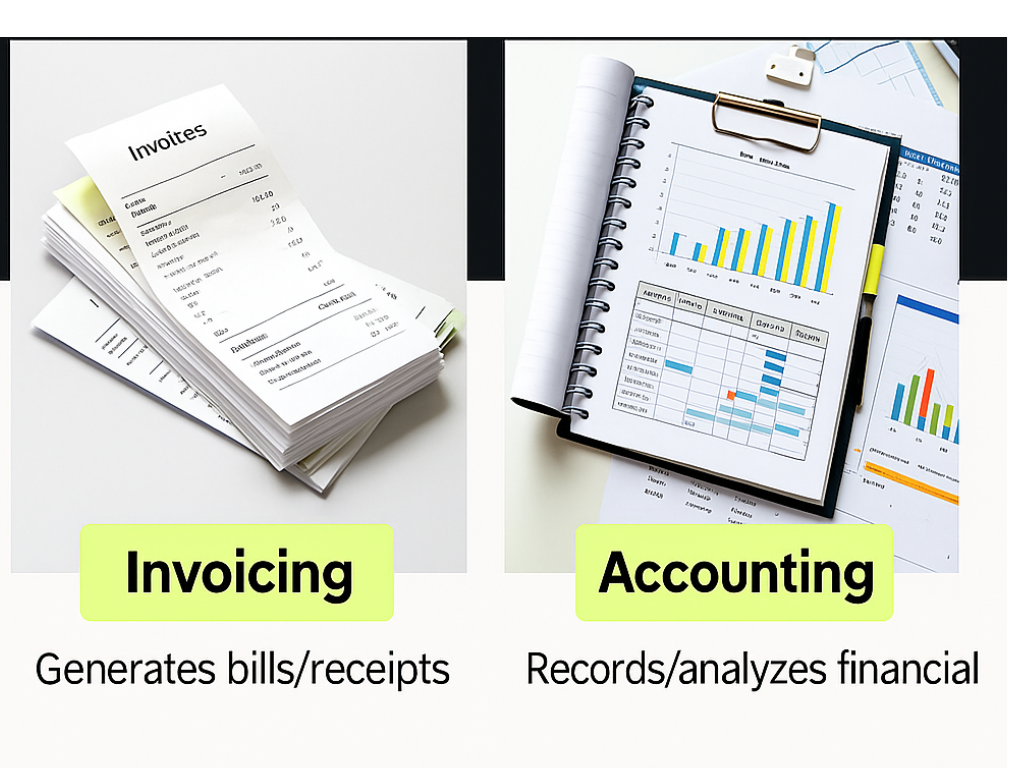

Invoicing and accounting are closely connected, yet they serve different roles in managing a business’s finances. Invoicing refers to creating and sending bills to customers for products or services. However, accounting goes further by tracking, organizing, and analyzing all financial transactions. Overall, this broader process helps businesses understand their financial health more clearly

What is Invoicing?

Invoicing is the process of creating bills to request payment from clients. Each invoice lists the products or services provided, along with their costs, payment terms, due dates, and accepted methods of payment. In addition, it serves as a record of the transaction, giving both the business and the customer clear information for payment and future reference. Meanwhile, invoices also act as legal proof if any disputes arise. Overall, they provide important details that help with tax reporting as well.

What is Accounting?

Accounting covers the entire cycle of financial management for a business. It includes documenting all transactions—income, expenses, assets, liabilities, payroll, and taxes—then using this data to prepare financial statements, analyze performance, ensure regulatory compliance, value the business, and help with decision-making. While invoicing is just one part of accounting, accounting transforms all business data, including invoices, into actionable insights for business growth and compliance.

Key Differences

| Aspect | Invoicing | Accounting |

|---|---|---|

| Purpose | Request payment for goods/services | Maintain and analyze all financial records |

| Scope | Bills, payments, customer records | Income, expenses, taxes, assets, liabilities, reporting |

| Main Output | Invoice documents | Financial statements, ledgers, regulatory filings |

| Users | Freelancers, small businesses, sales teams | All businesses, finance departments, auditors, regulators |

| Software Examples | Invoicing apps (Zoho, Wave, INVOISO.ai) | Accounting suites (Tally, QuickBooks, Busy, SAP) |

Why Both Matter

Invoicing ensures timely payments and customer clarity, supporting healthy business cash flow and customer trust. Accounting, meanwhile, gives a comprehensive view of financial performance, enables compliance with tax and legal requirements, and supports informed decision-making. Both are necessary for organized, scalable, and legally compliant business operations—good invoicing feeds directly into precise and insightful accounting.

Focus on Invoicing required to grow sales

Focusing on invoicing can significantly accelerate sales growth by optimizing cash flow, improving customer experience, and minimizing payment delays. Efficient invoicing systems enable businesses to send timely, accurate, and professional invoices, which builds trust and encourages prompt payments. Clear invoices reduce confusion, making it easier for customers to understand charges and pay on time. Automated invoicing also frees up valuable time for sales teams to pursue new leads and close deals instead of managing paperwork. By streamlining the billing process, businesses can reduce administrative bottlenecks, quickly reinvest incoming funds, and foster strong, ongoing client relationships—all key drivers for sustained sales growth. Accounting can be handled later on with seamless data integration.

Conclusion

while invoicing and accounting are closely connected, they serve different but complementary purposes within business finance. Invoicing focuses on generating and managing payments for sales transactions, ensuring smooth cash flow and customer transparency. Accounting, on the other hand, captures the broader financial picture, analyzing all business data—including invoices—to maintain compliance, assess performance, and guide strategic growth.